Oracle Fusion Financials Training

Trusted by 20,000+ professionals across India, the US, and Middle East.

About Oracle Fusion Financials Training

At UnoGeeks, our Oracle Fusion Financials Training is designed to make you project-ready and placement-focused from day one. With Oracle Fusion Cloud Financials implementations rapidly expanding across global enterprises, the demand for skilled Fusion Financials consultants specialising in General Ledger (GL), Accounts Payable (AP), Accounts Receivable (AR), Assets, and Cash Management is at an all-time high.

Oracle Fusion Financials professionals today command strong salary packages, with freshers securing competitive entry-level roles and experienced consultants earning high-paying positions in top consulting firms and MNCs. Our training goes beyond theory with real-time financial process implementations, end-to-end accounting scenarios, interview preparation, and live project-based learning to make you fully job-ready.

By the end of the program, you won’t just understand Oracle Fusion Financials — you’ll be ready to crack interviews and step into real finance implementation roles with confidence.

Our Students Work At

For Quick Questions

Oracle Fusion FIN 2026 Videos

Get Course Full Syllabus

Oracle Fusion Financials Training Course Details

About Oracle Fusion Financials

Oracle Fusion Cloud Financials is a comprehensive, cloud-native financial management suite that brings together all core finance operations — from General Ledger and Accounting Hub to Payables, Receivables, Cash Management, Fixed Assets, Tax, and financial reporting — on a single intelligent platform.

It enables organizations to automate financial processes, improve real-time visibility, strengthen compliance, accelerate closing cycles, and drive smarter financial decisions across global business environments.

Key Features & Capabilities

- Unified Financials Platform – Integrates all core finance functions in one cloud ecosystem

- End-to-End Finance Modules – General Ledger, Payables, Receivables, Assets, Cash Management, & Tax

- Real-Time Financial Visibility – Live dashboards, analytics, and reporting for faster decisions

- Advanced Reporting & Compliance – BI Publisher (BIP), OTBI, FRS & Smart View financial reporting

- Scalable Cloud Architecture – Secure, global-ready finance operationsIntegrated Data Management – Seamless data uploads using FBDI & Spreadsheet Loaders

Become a Certified Oracle Fusion Financials Consultant

Looking to build a high-paying career in Oracle Cloud Financials?

Join UnoGeeks’ Best Oracle Fusion Financials Online Training Program — trusted by hundreds of professionals and rated as one of the top Oracle Financials training institutes in the market.

We focus on real-time finance implementations, certification guidance, and job-oriented skills — not just theory.

What You Will Learn

- Fusion Cloud navigation, Functional Setup Manager (FSM) & security configurations

- General Ledger setups, accounting rules & financial controls

- Accounts Payable invoice processing & payment workflows

- Accounts Receivable billing, collections & revenue flows

- Cash Management, Tax configurations & reconciliation processes

- Fixed Assets management and depreciation processes

- Hands-on Financials module implementation for live enterprise projects

- Financial technical skills – OTBI, FBDI, SDL, FRS & Smart View

- Oracle Fusion Financials certification guidance and exam preparation

- Resume building + mock interviews with personalised feedback

- Job readiness support with regular financials job openings and referrals

🔔 Daily Oracle Job Alerts by UnoGeeks

Follow us on LinkedIn for real hiring updates: 👉 UnoGeeks Financials LinkedIn Jobs

Who Can Enrol in This Course?

- IT professionals looking to transition into Oracle Fusion Financials consulting

- Graduates & post-graduates aiming to kick start their career in Oracle Financials Cloud

- Freshers seeking high-growth IT roles with strong salary potential

Prerequisites

No prior Oracle or Financials experience required.

We cover all foundational concepts as part of the training, including:

- Basics of Oracle Fusion Financials Cloud

- Core finance and accounting business processes

Register for a Free Demo

Oracle Fusion Financials Training Course Curriculum

- Introduction to Oracle Fusion Cloud

- Oracle Cloud Application Product Families

- Architecture of Oracle Cloud Application

- Fusion Financials modules overview

- Fusion Security in cloud – Role Based Access Control

- Cloud Reporting Tools – BI, OTBI, FRC

- Course Content Overview

- Navigation in Oracle Cloud applications

- News Feed home page layout

- Banner Layout

- How to switch between layouts

- Predefined themes for home page layout

- Dashboards in Oracle Cloud applications

- Work Areas and Infotiles

- Tasks Panel – Access tasks, perform searches, run reports

- Infolets – Summary View, facilitates drilldown, Personalize

- Set User Preferences, save custom searches, Configure table columns

- Predefined themes for home page layout

- Role based access control - RBAC

- Configure security framework using Privileges, Duty roles, Job Roles, Abstract roles

- Assigning job roles to user and see the changes in application UI

- Create a custom role and compare it to standard role

- Explain other options available in IT Security Console

- Grant Data Access to user

- Financials Data Roles

- What is FSM?

- Explain key concepts of functional setup manager

- Features & Benefits of FSM

- Manage Setup data using 2 approaches – FSM or Implementation project

- Use Configuration Package to import and export set up data across instances

- Migration approach to move setup data from test to prod

- Understand Value Sets Concept

- Create 5 different types of Value Sets and use them in Flexfields configuration

- Configure Descriptive Flexfields (DFF), deploy and test it in application

- Configure Key Flexfields (KFF), deploy and test it in application

- Understand configuration levels of lookups

- Configuring Enterprise Structures

- Chart of Accounts Components and Business Units

- Other Spreadsheet Uses and Diagnostic Tests

- Legal Entity Overview and Legal Entity Relationship to Business Units and Ledgers

- Legal entities and Legal Reporting Units

- Demo: Uploading the Chart of Accounts File and Verify if the Deployment Was Successful

- Demo: Reviewing Legal Addresses for Legal Entities and Reporting Units

- Demo: Creating a Legal Entity

- Demo: Searching for Your Legal Entity

- Demo: Viewing a Legal Reporting Unit

- Value Sets, Chart of Accounts Structure, and Chart of Accounts Instance

- Demo: Manage Dependencies Between Chart of Accounts Segments Using Related Value Sets

- Segment Values

- Chart of Account Hierarchies

- Account Combinations and Segment Value Security

- Cross Validation Rules

- Calendars

- Currencies, Conversion Rate Types, and Daily Rates

- Demo: Searching for Your Value Sets

- Demo: Searching for Your Chart of Accounts Structure and Instance

- Demo: Deploying a Chart of Accounts

- Demo: Entering Values

- Demo: Searching and Completing Your Accounting Hierarchy

- Demo: Publishing Accounting Hierarchy

- Demo: Creating an Account Combination

- Demo: Defining Cross-Validation Rules

- Demo: Verifying Your Calendar

- Demo: Reviewing and Creating Currencies

- Demo: Creating Conversion Rate Types

- Demo: Entering Daily Rates

- Ledgers and Ledger Components

- Ledger Options and Balancing Segment Value Assignments

- Demo: Single Currency Journals

- Demo: Balanced Manual Journals by Entered Currency

- Reporting Currencies, Secondary Ledgers

- Completing Accounting Configuration, and The Balances Cube

- Ledger Sets and Data Access Sets

- Demo: Searching for Your Ledger and Verifying Your Ledger Options

- Demo: Verifying Your Legal Entities and Balancing Segments Assignments

- Demo: Defining Reporting Currencies

- Demo: Completing the Ledger Configuration

- Demo: Creating a Ledger Set

- Demo: Reviewing and Creating Data Access Set Security

- Approval Management Overview and Journal Approval Setup

Key Concepts, Assignee Tab, and Rule Sets - Rule Components and Task Configurations

- Approval Groups, Journals Page, and Simplified Workflow Rule Configuration

- Demo: Create Journal Approval Rules

- Accounting Periods and Period Close

- Revaluation and Translation

- Journal Import

- Demo: Opening the First Accounting Period

- Demo: Creating a Revaluation

- Prevent General Ledger Period Closure When Open Subledger Periods Exist

- General Ledger 21B: Journal Categories Excluded During Manual Journal Entry

- Demo: Journal Categories Excluded During Manual Journal Entry

- Document Sequencing

- Auto Post and Auto Reverse

- Demo: Creating a Special Journal Source and Category

- Demo: Creating an Accounting Sequence

- Understand Payables Terminology

- Managing Procurement Agents

- Managing Payment Terms

- Managing Common Options for Payables and Procurement

- Managing Invoice Options- Invoice Entry, Matching and Discount Options

- Managing Invoice Options- Prepayment, Approvals, Payment Request & Self-Service Inv Options

- Managing Payment Options

- Manage Payables Calendars

- Manage Tax Reporting and Withholding Tax Options

- Manage Payable Lookups and Descriptive Flexfields

- Manage Payables Document Sequences

- Manage Distribution Sets

- Manage Invoice Tolerances, Holds and Releases

- Managing Additional Optional Tasks to Configure Payable

- Demo: Defining Your User as a Procurement Agent

- Demo: Creating a Payment Term

- Demo: Managing Common Options for Payables and Procurement

- Demo: Managing Invoice Options

- Demo: Managing Payment Options

- Demo: Managing Distribution Sets

- Configuring Oracle Payments: Payables

- Configuring Payment System Connectivity

- Disbursements Overview

- Manage Payment Methods and Payment Codes.

- Manage Payment Process Profiles

- Manage Payment Process Requests

- Manage Payment Approvals

- Customer Supplier Netting

- Demo: Creating Banks, Branches, and Accounts

- Demo: Creating a Payment Document for a Bank Account

- Demo: Creating a Disbursement Payment File Format

- Demo: Creating a Payment Method

- Demo: Creating a Payment Process Profile

- Demo: Submitting a Payment Process Request

- Overview of Oracle Tax

- Foundation Tax Configuration Overview

- Regime to Rate Configuration

- Manage Rapid Implementation of Taxes

- Understand Tax Determination Process

- Understanding Tax Reporting Configurations

- Manage Tax Simulations.

- Demo: Assigning Your Business Unit to a Tax Regime

- Configuring and Using Subledger Accounting

- Accounting Methods Overview

- Accounting Event Model

- Accounting Methods and Rules Flow

- Understand Multi Period Accounting

- Manage Mapping Sets

- Manage Account Rules and Description Rules

- Manage Supporting References

- Manage Journal Line Rules and Journal Entry Rule Sets

- Manage Accounting Methods

- Suppliers

- Demo: Creating a Supplier

- Payable Invoices Overview

- Payable Invoice Types

- Payable Invoice Components and Invoice Validation

- Payable Invoice Approval

- Configurable Payables Workflow Notification

- Demo: Opening General Ledger and Payables Periods

- Demo: Creating a Manual Invoice

- Demo: Creating an Invoice from Spreadsheet

- Predefined Reports in Payables

- Payables Infotiles

- Predefined Reports in Payments

- Predefined Reports in Subledger Accounting

- Demo: Running the Payables Invoice Register Report

- Demo: Running a Subledger Accounting BI Publisher Report

- Configuring Oracle Cash Management

- Manage Bank, Branches and Bank Accounts

- Key Setup Tasks for Bank Statement Processing

- Upload of MT940 and Spreadsheet statement

- Bank Statement Reconciliation Setups-Part1

- Performing Bank Statement Reconciliation

- Reporting and Analysis in Cash Management

- Manage Bank Account Transfers and Adhoc Payments

- Additional Setups and Features in Cash Management

- Demo: Managing Bank Statement Transaction Codes

- Demo: Managing Bank Statement Transaction Creation Rules

- Demo: Managing Bank Statement Reconciliation Tolerance Rules

- Demo: Managing Bank Statement Reconciliation Matching Rules

- Demo: Managing Bank Statement Reconciliation Rule Sets

- Demo: Assigning a Rule Set to a Bank Account

- Demo: Performing a Bank Statement Reconciliation with Auto reconciliation

- Billing System Options: Email Delivery, Late Charges and AutoInvoice

- Cash Processing System Options and Rapid Implementation Values in System Options

- Auto Accounting, Remit-to Addresses and Receivables Activities

- Statement Cycles, Statement Email Delivery and Approval Limits

- Optional Implementation Tasks, Document Sequencing, and Credit Memo Workflow

- Demo: Reviewing Receivables System Options

- Demo: Reviewing Auto Accounting Rules

- Demo: Reviewing Remit-to Addresses

- Demo: Reviewing Receivables Activities

- Demo: Reviewing Statement Cycles

- AutoInvoice Overview, Profile Options and Transaction Flexfields

- Payment Terms, Transaction Types, Transaction Sources and Memo Lines

- Demo: Defining a Transaction Type

- Demo: Defining a Transaction Source

- Banking Setups and Receipt Classes

- Receipt Sources

- Demo: Creating Banks, Branches, and Bank Accounts

- Demo: Creating a Receipt Class and Receipt Method

- Demo: Creating a Receipt Source

- Revenue Recognition Setups and Revenue Scheduling Rules

- Revenue Policies and Contingencies

- Overview of Oracle Tax

- Foundation Tax Configuration Overview

- Regime to Rate Configuration

- Third Party Tax Partner Integration

- Manage Rapid Implementation of Taxes

- Understand Tax Determination Process

- Understanding Tax Reporting Configurations

- Manage Tax Simulations.

- Demo: Assigning Your Business Unit to a Tax Regime

- Subledger Accounting Overview

- Event Model and Rules Overview

- Formula Functions and Mapping Sets

- Account Rules, Description Rules and Supporting References

- Journal Line Rules, Journal Entry Rule Sets and Accounting Methods

- Accounting Rule Migration, Create Accounting Process and Subledger Accounting Features

- Error Messaging and Detailed Accounting Distributions Features

- Demo: Duplicating and Modifying an Accounting Method

- Cash Management Overview and Banking Setups

- Bank Account Transfers, Transaction Type Mapping and Transaction Codes

- Parse Rule Sets

- Transaction Creation Rules, External Transactions and Bank Statement Processing

- Reconciling Journal Entries

- Setups for Automatic Bank Statement Reconciliation

- Reports, Infolets and Cash Positioning

- Forecasting and The Transactions Cube

- Demo: Managing Bank Statement Transaction Codes

- Demo: Managing Bank Statement Transaction Creation Rules

- Demo: Managing Bank Statement Reconciliation Matching Rules

- Demo: Managing Bank Statement Reconciliation Tolerance Rules

- Demo: Managing Bank Statement Reconciliation Rule Sets

- Demo: Assigning a Rule Set to a Bank Account

- Demo: Performing a Bank Statement Reconciliation with Auto reconciliation

- Customer Model and Trading Community Model

- Customer Profile Classes

- Customer Creation

- Demo: Defining a Customer Profile Class

- Demo: Creating a customer

- Receivables Overview and Transactions Overview

- Creating Transactions and Customer Payments

- Demo: Opening General Ledger and Receivables Periods

- Demo: Creating a Manual Invoice

- Demo: Creating a Receipt

- Demo: Submitting Create Accounting in Draft

- Demo: Submitting Create Accounting in Final/Post

- Bill Management Overview, Features, and Setups

- BI Publisher Reports for Receivables

- Subject Areas and OTBI Reports for Receivables

- Receivables to Ledger Reconciliation Report

- Receivables Infotiles and Subledger Accounting Reports

- Cash Management Reports and Tax Reports

- Create Value Sets for Category KFF

- Create Value Sets for Location KFF

- Create Value Sets for Asset Key KFF

- Create Category KFF Structure

- Create Location KFF Structure

- Create Asset Key KFF Structure

- Create Category KFF Structure Instance

- Create Location KFF Structure Instance

- Create Asset Key KFF Structure Instance

- Create Segment Values to 3 KFF Segments

- Configure System Controls

- Create Fiscal Year Calendar

- Create Asset Calendar

- Define Prorate Convention

- Create Prorate Calendar

- Create Asset Book

- Create Tax Book

- Create Asset Categories

- Overview on Asset Book Role Template

- Manual Additions

- Asset Creation using Spreadsheet ADFdi

- Mass Additions

- Merge Asset Lines

- Split Asset Lines

- CIP Asset & CIP Capitalization

- Revaluation

- Impairment of an Asset

- Run Depreciation (Draft/Final)

- What-if Analysis

- Rollback Depreciation

- Asset Retirement

- Asset Reinstatement

- File Based Data Import (FBDI) Process – Assets

- Create Accounting Entries & Transfer to GL

- Assets Period Close Process

- Assets to General Ledger Reconciliation

- Managing Intercompany System Options

- Manage Intercompany Transaction Types

- Manage Intercompany Period Status

- Manage Intercompany Organizations

- Manage Intercompany Organization Data Access for Uses

- Manage Intercompany Customer Supplier Association

- Manage Intercompany Receivables Assignment

- Manage Intercompany Balancing Rules

- Create Transaction

- Manage Intercompany Outbound Transactions

- Manage Intercompany Inbound Transactions

- Transfer to Receivables

- Transfer to Payables

- Transfer to General ledger

- Build SQL Queries and Creating Data Model

- Design report layout using RTF

- Register and execute BIP report as ESS Job

- Test and explore ESS Job Submission options from scheduled processes

- Build OTBI Detail Report

- Build OTBI Summary Report

- OTBI Dashboards

- FBDI Overview

- Data file preparation in FBDI format

- Execute File Based Data Import (FBDI) process

- Error handling and reconciliation

- ADFDI Overview

- Data file preparation in SDL format

- Execute Spreadsheet Data Loader (SDL) process

- Error handling and reconciliation

- Getting started with FRC

- Explore various options available in FRC reports

- Execute seeded FRC report and understand the report design In Depth

- Deploy and execute custom report from FRC work area

- Introduction to Sandboxes

- Make changes in UI with sandbox – Ex: Make fields required/read only/hidden

- Use expression language to write complex conditional logic

- Implement Fusion Financials for a Live Project

- Understand the requirement and come up with config workbooks

- Configure Financials Modules as per Config workbook

- Implement Financials Modules as per Config Workbooks

- Test the setups

- We will provide most comprehensive guidance in Fusion Financials Certification

- We will share couple of resumes and help you to come up with Perfect Fusion Financials resume

- We will teach all possible interview questions in Fusion Financials

🎥 Watch How We Teach Oracle Cloud

🎓 Learn From Our Most-Watched real-time Oracle Cloud Sessions

For Quick Questions

Oracle Fusion FIN 2026 Videos

Get Course Full Syllabus

Oracle Fusion Financials Lead Trainer – Industry Expert for FIN Training at UnoGeeks

100+ Live Batches Delivered

2000+ Professionals Trained

25+ Years Oracle SCM Experience

Mr. Mohan is the Lead Oracle Fusion Financials Trainer at UnoGeeks and a seasoned industry expert with over 25+ years of experience delivering complex Oracle Fusion Financials Cloud implementations for top US-based product companies and global consulting firms.

He specialises in end-to-end Oracle Fusion Financials functional training, guiding professionals through real-world implementations of General Ledger (GL), Accounts Payable (AP), Accounts Receivable (AR), Cash Management, Tax, Fixed Assets, FRS, Smart View, and enterprise-scale data migration using FBDI & Spreadsheet Loaders.

Having led high-value financial transformation programs across multinational organizations, Mr. Mohan brings deep implementation insight into every training session. His hands-on, project-driven methodology ensures learners gain practical exposure to live accounting processes, financial controls, reporting frameworks, and compliance-ready cloud finance environments — enabling them to confidently step into Oracle Fusion Financials consultant roles and excel in real client projects and interviews.

Earn Your Oracle Fusion Financials Certification with Confidence

Showcase your expertise with an official certificate recognized by employers.

UnoGeeks Sample Certificate

🎓 Official Certification

Earn an official course completion certificate validating your practical Oracle Fusion Financials expertise

🔗 Oracle Certification

You will easily clear Oracle Certification Exams & Become a Certified Fusion FIN Implementer

🌍 Industry Recognition

Strengthen your resume with widely recognized credential trusted by employers and consulting firms.

🚀 Career Advancement

Gain hands-on Oracle Fusion Financials skills that help you stand out & advance in your career

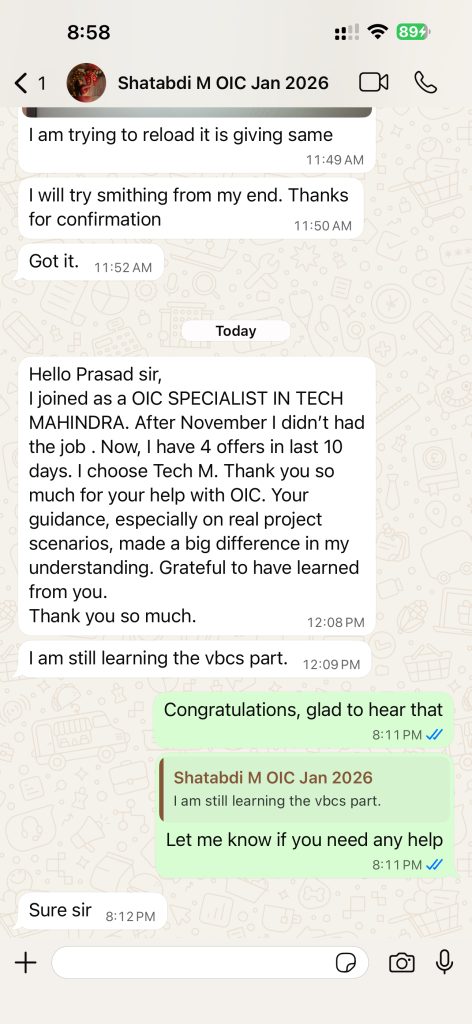

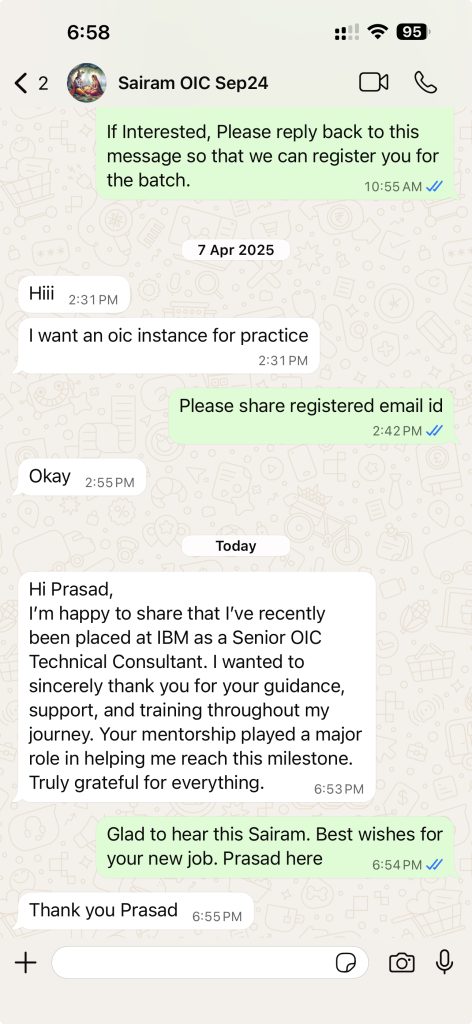

Few Success Stories from Our Students ✅

✅ “Recent real placements & live student messages (updated regularly)”

Oracle Fusion Financials Consultant Jobs & Salary Trends

📈 High Market Demand

Oracle Fusion Financials skills are in strong demand as enterprises modernise their finance operations and migrate legacy accounting systems to Oracle Cloud. Organizations across industries require skilled Financials consultants to manage general ledger, payables, receivables, assets, taxation, and financial reporting — creating thousands of job opportunities across consulting firms, shared service centers, and global enterprises.

🏢 Used by Global Firms

Leading organizations across banking, manufacturing, healthcare, retail, IT services, and multinational enterprises rely on Oracle Fusion Financials Cloud to run mission-critical finance operations. Fusion Financials consultants play a key role in implementing end-to-end financial processes, ensuring compliance, automating accounting workflows, optimizing reporting, and supporting large-scale enterprise transformations.

💰 Attractive Salaries

Oracle Fusion Financials consultants earn highly competitive salaries worldwide, driven by strong demand for professionals with real-time implementation experience and functional expertise. Freshers secure solid entry-level finance cloud roles, while experienced Financials consultants consistently command premium compensation packages in top consulting firms, MNCs, and global finance transformation projects.

Our Training Advantage

Learn from Certified Experts

Get trained by Industry-Certified professionals with deep real-world Oracle Cloud implementation experience

Real-Time Implementation Projects

Learn through real project scenarios that mirror actual client implementations & production use cases.

Interactive Live Training Sessions

Highly interactive live sessions with recordings provided, so you never miss a discussion.

Resume, Interview & Job Assistance

Guidance on resume building, interview preparation, and job support tailored to Oracle Cloud roles

Live Demos Before Enrolment

Attend up to 3 live demo sessions to evaluate the trainer, content quality, and teaching approach

24×7 Learning Support

Prompt support for queries, doubts, and technical issues throughout your learning journey.

What Students Say on Google

⭐ Rated 4.8★ by 600+ Google Reviews

Trusted by hundreds of professionals across Oracle Cloud domains

Free Career Call – Talk to Our Training Experts

Get batch details, syllabus, demo schedule, and fee structure — no obligation

+91 73960 33555

Get Batch Dates, Fees & Demo Details

+91 73960 33555

Mon–Sat | 6 AM – 10 PM IST

info@unogeeks.com

For detailed queries

Live Chat

Chat with our support team now

Trusted by 5,000+ learners | 500+ real-time batches completed

Why Students Trust UnoGeeks

500+

Real-Time Batches Completed

5000+

Happy Students

5 *****

Star Ratings

20+

Expert Trainers

Oracle Fusion Financials Training 2026 Batch Slots

WeekDay Batch 1

Monday – Friday

07:00 – 08:15 AM (IST)

WeekDay Batch 2

Monday – Friday

08:15 – 9:30 AM (IST)

WeekDay Batch 3

Monday – Friday

07:00 – 08:30 AM (IST)

Oracle Fusion Financials Training 2026 FAQs

Oracle Fusion Financials Training teaches professionals how to implement and manage Oracle ERP Cloud Financial modules such as General Ledger (GL), Accounts Payable (AP), Accounts Receivable (AR), Fixed Assets, Cash Management, and Expense Management.

With enterprises rapidly migrating from on-premise ERP to Oracle Cloud Financials, demand for trained Fusion Financials consultants has surged globally. Companies prefer professionals who can handle real-time cloud implementations, integrations, reporting, and month-end close processes.

Yes. Oracle Fusion Financials is a highly future-proof career.

Cloud ERP adoption is accelerating across industries, and organizations continuously hire skilled Financials consultants for implementations, automation, compliance, and global rollouts. Strong salaries and long-term growth make it a top ERP career choice.

A complete Oracle Fusion Financials course generally covers:

General Ledger (GL), Accounts Payable (AP), Accounts Receivable (AR), Fixed Assets, Cash Management, Expense Management, Financial Reporting (BIP & OTBI), Period Close Process, and Security & Setup Manager.

Advanced programs also include integrations and real-time project scenarios.

There is no functional difference.

Oracle Fusion Financials refers to the Financial modules inside Oracle ERP Cloud. Both terms are commonly used interchangeably in the industry.

Yes. Oracle Fusion Financials online training is highly effective when delivered with live instructor-led sessions, hands-on cloud environments, real project workflows, and interview preparation.

Many professionals prefer online learning for flexibility and practical exposure.

A finance background is helpful but not mandatory.

IT professionals, ERP support staff, and fresh graduates can successfully learn Fusion Financials with structured training that explains both accounting concepts and system configuration.

Functional training focuses on business process flows, module setups, transaction processing, period close activities, and financial reporting.

It prepares learners to work as Oracle Fusion Financials Functional Consultants on real ERP Cloud projects.

Technical training covers integrations, FBDI data loading, BI Publisher reports, OTBI analytics, web services, security configurations, and automation.

It is ideal for developers and technical ERP professionals.

Yes. Oracle Fusion Financials certification improves resume shortlisting, salary opportunities, and project credibility.

Certified professionals are preferred by consulting firms and global enterprises implementing Oracle ERP Cloud.

Most learners take:

2–3 months to understand core modules

3–4 months with real-time projects and advanced topics

4–6 months to become fully job-ready

With focused training, interviews can start within a few months.

Common roles include:

Oracle Fusion Financials Functional Consultant

ERP Cloud Analyst

Finance Systems Consultant

Oracle Financials Support Consultant

Implementation Consultant

These roles are in high demand worldwide.

Typical salary ranges (approximate):

Freshers: ₹6–10 LPA

2–4 years experience: ₹12–20 LPA

5+ years experience: ₹20–35+ LPA

Cloud ERP skills attract premium compensation.

It is not difficult when taught with hands-on implementation scenarios.

Understanding business flows and system configuration step-by-step makes learning smooth even for beginners.

Yes. Many companies are shifting from legacy ERP platforms like SAP ECC and Oracle EBS to Oracle Fusion Cloud because of automation, scalability, lower infrastructure cost, and continuous updates.

Fusion Financials skills are increasingly future-relevant.

Quality programs typically include live cloud access, functional configuration, technical exposure, real-time projects, interview preparation, and resume support.

This makes learners industry-ready.

Yes. Freshers often start as junior consultants, ERP analysts, or support associates on cloud ERP projects.

Strong hands-on training significantly improves placement opportunities.

Oracle Fusion Financials is Oracle’s modern cloud ERP, while EBS is a legacy on-premise system.

Fusion offers automation, real-time reporting, scalability, and lower maintenance, making it the preferred platform for new implementations.

Functional roles do not require coding.

Technical roles may involve SQL, integrations, reports, and web services, depending on job profile.

t validates skills in chart of accounts, ledgers, journal processing, period close, and financial reporting within Oracle Fusion Financials.

It is one of the core certifications in ERP Cloud Financials.

UnoGeeks provides real-time project-driven Oracle Fusion Financials training with complete module coverage, certification preparation, live implementation scenarios, resume guidance, mock interviews, and regular job updates to make learners fully job-ready.